In this Edition

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430 (San Francisco office)

6517 Lakeview Drive

Falls Church, VA 22041

(703) 609-7494 (Washington, DC office)

2122 Hancock Street

San Diego, CA 92110

(619) 550-1187 (San Diego office)

8538 173rd Avenue NE

Redmond, WA 98052

(206) 571-0128 (Seattle office)

www.TBDconsultants.com

LOGIC NEED NOT APPLY

Geoff Canham, Editor

So, the politicians play their usual game of chicken with the debt limit, finally reaching a compromise settlement at the last minute, as everyone knew they would. Instead of ‘chicken’ I was thinking of saying ‘brinksmanship’, but that sounded too mature. The S&P tries to lecture the politicians into behaving sensibly, and when that fails they throw a hissy-fit and downgrade the US from AAA to AA+. Since that is a downgrade of US Treasuries and has no bearing on stocks, the public immediately starts selling stocks and buying US Treasuries. From that we can gather that the general public is just as capable of acting illogically as politicians and rating agencies are.

Not that there are no serious problems with the economy worldwide. Yes, there are substantial national debt problems in Europe, but the acronym PIIGS has been around for a long time and yet it seems that it is only recently that some people have cottoned on to the fact that the S stands for Spain and one of the Is stands for Italy. And yes, the US has serious debt problems and growth is anemic. If you were to deliberately reduce your income and then start throwing money around as if it grew on trees, then you would soon have a serious debt problem. That is basically what the government has been doing (with the best of intentions), so the debt problem shouldn’t be surprising to anyone. And if you have been noticing how the employment situation has been stubbornly refusing to improve, you probably have not been surprised to find that the economy is scarcely growing.

What about all the talk of a double-dip recession? Some people have enough problems believing we have, at least technically, emerged from the last recession. The popular definition of a recession is “two consecutive down quarters of GDP”, and with GDP running at minimal levels anyway, it would certainly be easy to have it drop into negative territory for a time. But that doesn’t mean we have to be in for another round of what we went through in 2008. Certainly the banks have not been lending money to anyone that asks, as they were doing before the Recession with a capital-R; in recent years it has been hard enough to get them to lend money to you, even if you could prove that you don’t need it. It is sad to say, but even if we do have a double-dip to the recession many people will not notice because we haven’t risen far enough for a fall to have much effect. The stock market will play its volatile games, of course, but we expect that as much as we expect politicians to not compromise without a metaphorical gun to their heads.

All this may sound rather gloomy, especially when you add in the effects of the debt deal, which means that the Federal and local governments will be forced to cut back on spending. However, there are still positive signs from the private sector, and that is where any long-term growth has to come from. Company reserves are high, employment is edging up, even if it is painfully slow, and consumers are still consuming, and by last count increasing that consumption.

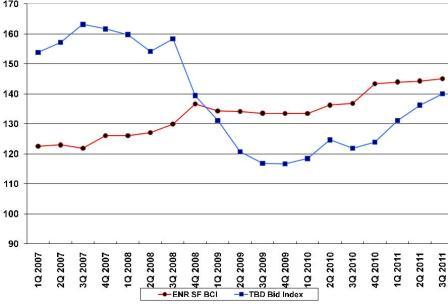

But where does that leave the construction industry? We are seeing some signs of a pick-up, but as with the employment situation, it is only a small improvement. The measures to reduce the debt are certainly going to mean reductions in government-funded projects, especially with the stimulus money being used up. In our 4th Quarter 2009 edition of the newsletter we plotted the timeline of the recession of the early 90’s against the Great Recession, and that showed the construction industry getting back on track around mid-2013. By coincidence, that is the date until which Ben Bernanke promises to keep interest rates low. Of course, this recession was deeper and has had a lot more worrying overtones, and the recent roller-coaster ride certainly hasn’t boosted anyone’s confidence, but things are still moving in the right direction, so that timeline might yet prove reasonable.

Washington, DC, does have a substantial influence on the economy. The Federal government is the authority under the constitution that can print money, and they have, up to this point, been good at spending it. But this nation has a capitalist economy, and that is supposed to depend on the private sector, and with governments of all creeds having dug themselves into a giant debt-hole, the private sector is going to have to take up the slack.

As we move forward, however, don’t expect it to be a logical progression.

In this article we look at the involvement of governments, from Federal to local, in the green-building movement, looking at how they are setting examples and encouraging the movement, and now starting to legislate about it.

In this article we look at the GSA's involvement in Building Information Modeling, and how they are trying to develop its potential uses.

Design consultant: Katie Levine of Vallance, Inc.