In this Edition

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430 (San Francisco office)

1663 Eureka Road

Roseville, CA 95661

(916) 742-1770 (Sacramento office)

4361 35th Street

San Diego, CA 92104

(619) 550-1187 (San Diego office)

8538 173rd Avenue NE

Redmond, WA 98052

(206) 571-0128 (Seattle office)

2063 Grant Road

Los Altos, CA 94024

(650) 386-1728 (South Bay office)

9705 Cymbal Drive

Vienna, VA 22182

(703) 268-0852 (Washington, DC office)

www.TBDconsultants.com

LEED has already caused quite a revolution in the construction industry, to the point that building 'green' is now the norm. But the next version of LEED is going to push the envelope further. Here we take a look at what LEED v4 holds in store.

Building green is one thing, but can you 'demolish green'? In this article we look at how deconstruction varies from traditional demolition.

Markets have been in a bit of a holding pattern at the start of the year, but positive movement continues. Writing towards the end of February (before the Crimea events exploded), the Dow doesn’t seem to know whether it wants to be just above or just below 16,000, unemployment remains stubbornly high but still improving, and retail sales have been disappointing but not discouraging. The adverse weather, that has affected large portions of the country, has been blamed for much of the disappointing results, so we wait to see what spring brings.

The stock market did manage to avoid the widely expected ‘correction’, with the Dow only falling around 7.5% before starting to recover, rather than the 10% drop that would constitute an official correction. Strangely, the best news for the markets came from Congress, when they agreed to raise the debt ceiling without a battle. OK, they didn’t officially ‘raise’ it, rather ‘suspending the limit’, or in other words accepting whatever it is going be until the next deadline comes around in March 2015. What is $17.2 trillion between friends?

The new head of the Fed, Janet Yellen, announced that the Fed would be continuing to taper its bond-buying program, and basically continue the same policies that Ben Bernanke had been following. That disappointed some people who hoped the employment statistics would lead to the Fed tapering its taper, but the market as a whole responded positively because what it likes, more than anything, is certainty.

Greece is still struggling with an unemployment level that makes the US rate look great. It has 28% unemployed, and for those under age 25 the rate is 61.4%, and that is expected to continue to increase for a while, but the country is set to emerge from recession and start showing growth again this year. The Eurozone as a whole has been showing growth, albeit a lowly 0.3% for the final quarter of 2013, but the signs are that it will continue to improve, with even Italy showing growth for the first time since 2011.

The so-called emerging markets had been a concern as the Fed’s tapering began, but that has proved to be less of an issue than originally feared.

China is taking steps to rein-in its burgeoning credit problem, and is trying to turn its economy from being export oriented to consumer-oriented. This could be good for companies exporting to China, but might signal a slow-down in some of the construction projects there since most such projects are financed through credit. China’s recent positive trade figures suggest that China might overtake the US this year as the world’s largest trading nation.

For people that are involved with Bitcoins, the start of the year has definitely been a trying period, but anyone that considers the current state of online security to be one they trust their wealth to obviously hasn’t heard of Target and is in need a sharp wake-up call. Lawmakers in New York are talking about introducing regulations for the currency, but since it was designed to be unregulated and there are no longer any major Bitcoin exchanges operating in New York, it is hard to see how such regulations will have any effect.

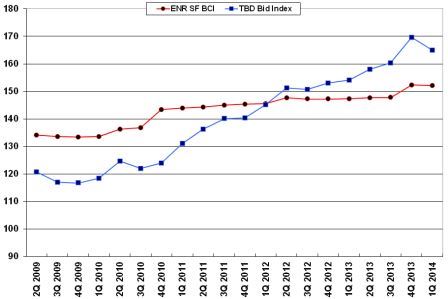

So, the markets generally appear to be in a holding pattern, but the construction market here seems to be one of the sectors that are gaining. The improvement in unemployment may have been less than hoped for across the board, but a substantial part of the new jobs arose in the construction industry.

Geoff Canham, Editor

Design consultant: Katie Levine of Vallance, Inc.