Printable PDF version

Subscribe to our newsletter

IoT and Construction

Net Zero and the Envelope

When's the Next Recession

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430 (San Francisco office)

1663 Eureka Road

Roseville, CA 95661

(916) 742-1770 (Sacramento office)

9449 Balboa Avenue, Suite 270

San Diego, CA 92123

(619) 518-5648 (San Diego office)

8538 173rd Avenue NE

Redmond, WA 98052

(206) 571-0128 (Seattle office)

2063 Grant Road

Los Altos, CA 94024

(650) 386-1728 (South Bay office)

P.O. Box 492115

Los Angeles, CA 90049

(424) 343-2652 (Los Angeles, CA office)

www.TBDconsultants.com

If the Internet isn't already all-pervasive enough, we are starting it see it reach into more corners of our lives. Here we look at how the Internet of Things is moving into the construction industry.

As the goal of achieving Net Zero becomes more common, we look at how the enclosure of the building can assist in reaching that target.

After seeming to nosedive at the beginning of the year, stocks have (at time of writing in early May) recovered most of the losses, but they still donít seem to know if they want to go up or down. The Dow hit its all-time high of 18,312.39 on May 19, 2015, and has come reasonably close to that a few times since, but never quite got there again.

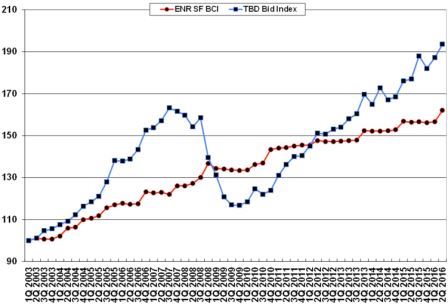

If you look at the dates that US recessions have occurred since the 1960ís, we see them starting in years 1960, 1969, 1973, 1980/81, 1990, 2001, and 2007, so if you believe in cycles and history repeating itself, we are just about due for another recession. Looking at our Bid Index, we are definitely seeing a similarity with the way bid prices have risen compared to the way they did coming up to the Great Recession. But the situations between then and now have some marked differences. In 2007, prices were pushing higher because the economy was overheating, helped by banks offering loans to almost anyone that asked, and contractors were struggling to meet the ever growing demands of developers. Contractors again are having a problem with meeting demands today, but that is not because demands are that excessive, and certainly not because they are being fueled by easy borrowing. This time it is because so many craftsmen left the industry after the bust that contractors are finding it hard to staff the projects they have.

The Spring 2016 Confindex Report (published by the CFMA) shows that while members of the construction industry generally feel optimistic for 2016, there is more concern with how things will go in 2017. Part of that could be the natural tendency to be concerned regarding events further out in the future, and the feeling that the improving market conditions wonít go on forever. But so far the economy hasnít improved enough for the Federal Reserve to fully release the training wheels it fitted to stop the economy falling over completely during the last recession. It has stopped the so-called quantitative easing and made tentative moves at increasing interest rates, but we are certainly not back to normal (whatever that is). The unemployment levels are down to what is normally considered full employment, but many people can still only find part-time work when they would prefer full-time, and there has been very little upward pressure on wages. Outside of the US, we do still find quantitative easing being employed by some central banks, and we have even seen negative interest rates being used.

It is unclear exactly what is happening in China, but certainly their economy has been slowing. The proportion of US trade that goes to China is not huge, but companies had been looking to that region as an area of potential expansion, and those opportunities are seen to be retreating. Russia continues to struggle under the dual effects of the oil price collapse and the sanctions imposed after its actions in Ukraine. Russia is certainly not the only nation suffering because of oil prices, and while oil has been recovering from its lows, its price is still only a fraction of what it was not long ago. Although US oil production has been decreasing, the global glut of oil supplies continues to increase, so oil prices cannot be expected to recover much more in the near future, and are likely to remain at least as volatile as the Dow Jones index.

The European Union has seen some improvements in growth recently, but they have been slower in recovering than the US, so they still have some catching up to do. Meanwhile, growth projections have been reduced in the US, and certainly the election rhetoric has not been talking-up the economy.

The collapse of the housing market was an early sign ahead of the Great Recession. Back in March 2007, the median price for a new house in the US peaked at $262,600 before collapsing, yet by November 2015 that median price had climbed back up to $317,000. But it is interesting to note that in December 2015, a month after the new peak in house prices was seen, the Fed made a small increase in interest rates and the median house price was down to $297,900 in March this year. That seems to indicate fragility in the market, although by April it had shot up to $321,100.

In conclusion, this writer would say that although there may be indications to suggest at least the possibility of a shallow recession within the next two to three years, there are too many variables involved to say with any measure of certainty when, how deep, how widespread or how long it could be. On the positive side, consumers tend to be in good financial shape, having learnt from the past recession, and the Architectural Billings Index has just had its first three consecutive months of growth since July 2015.

Geoff Canham, Editor

Design consultant: Katie Levine of Vallance, Inc.