Printable PDF version

Subscribe to our newsletter

The Fedís Difficult Task

The Supply Chain

Interest Rates on the Up and Up

Construction

Management Specialists

San Francisco, CA

(415) 981-9430 (San Francisco office)

Orinda, CA

(415) 981-9430 (Orinda office)

Rocklin, CA

(415) 872-0996 (Sacramento office)

San Diego, CA

(858) 886-7373 (San Diego office)

Redmond, WA

(206) 571-0128 (Seattle office)

Los Altos, CA

(650) 386-1728 (South Bay office)

Los Angeles, CA

(424) 343-2652 (Los Angeles, CA office)

Wicklow, Ireland

+353 86-600-1352 (Europe office)

www.TBDconsultants.com

Can the Federal Reserve bring down inflation and not create a recession at the same time? Here we look at some of the issues faces them, and what the implications are for the construction industry.

Scheduling a construction project became even more complicated than usual as material delivery times became uncertain and changing. In this article we address the problems affecting the supply chain that led to this issue.

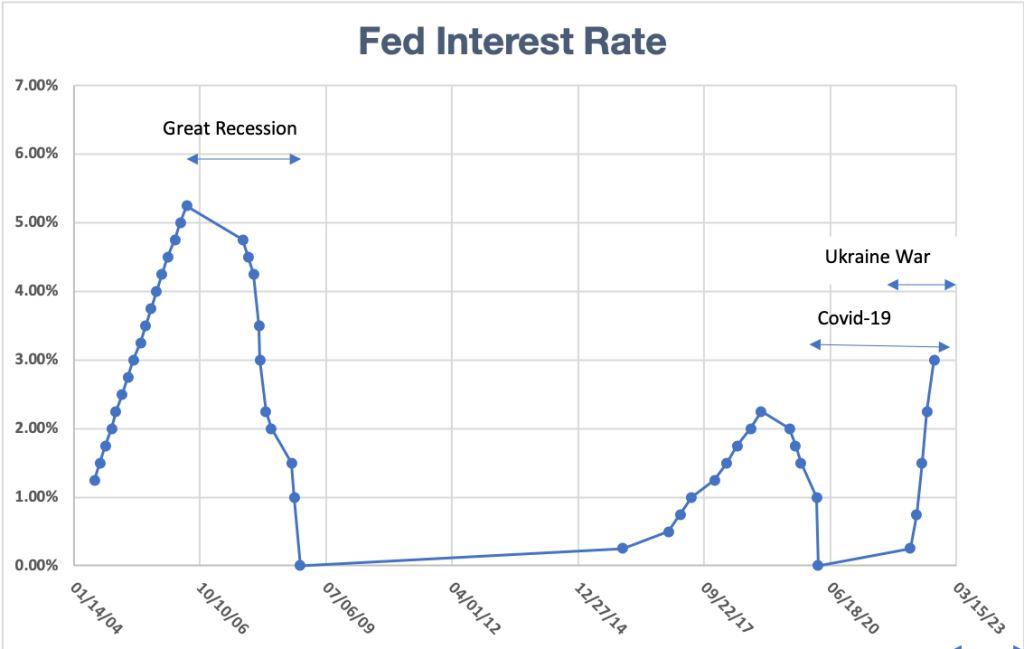

Interest Rates on the Up and Up

After a year of suggesting that inflation was temporary, the Federal Reserve has reversed course and started trying to bring inflation under control by aggressively raising interest rates. That does not directly affect prices but is aimed at lowering demand because it is the balance between supply and demand that traditionally sets the price level for a product. High demand means that manufacturers must ramp up production, which increases their costs. Often manufacturers will offset those costs with higher prices. Those high prices will, in turn, entice others into supplying the product or service. This brings increase in supply, leading, in time, to suppliers cutting prices in order to maintain their share of the market. The problem the Fed has, is trying to balance the effects on demand so that they can bring inflation under control while not sending the country into recession.

We have had low interest rates for years, as the Fed tried to spur the economy after the Great Recession and then to counter the disruption caused by Covid-19. Unfortunately, the latter was not a disruption that responded well to the tools available to the Fed. While the markets loved the idea of cheap money, Covid was a medical crisis that kept people at home and gave them limited opportunity to spend their stimulus checks on goods and services, and low interest rates meant that leaving the money in the bank wasnít a good idea. By default, the money got put into the stock market, which pleased Wall Street no end, while leaving High Street with struggling businesses and shuttered storefronts.

During the lockdowns, the work-from-home climate gave people reason and opportunity to look for larger housing units and maybe move out of that city apartment and into a house. That increased demand in the housing market got prices rising, helping to spark inflation. Covid hasnít gone away, but the situation has changed, allowing restrictions to be rolled back and permitting people to get out and spend. That gave increased demand for all types of goods and services, which suppliers were not necessarily able to meet. Restrictions that were imposed as Covid moved in waves around the globe had disrupted the supply chain, and workers had been forced to discover that they had options in what they did, leading to manufactures being limited in how much they could produce, disrupting the supply-demand balance again.

To add to the problems, Russia went and invaded Ukraine sparking a fuel shortage that OPEC seems reluctant or unable to compensate for. The war also affected the food supply, which was already being hampered by climate change and workers being unavailable due to Covid. Fuel and food prices have been dropping from their highs, but they remain elevated well above pre-pandemic levels.

Unemployment has been close to record low levels and, while job growth figures faltered a bit in May, by July it was back to beating estimates and unemployment figures were heading lower again. That sounds like good news, but not when the Fed is trying to rein in inflation. The reason for that is that having a lot of unfilled job positions available gives leverage to job seekers to push wage levels higher, moving inflation the wrong way again.

Recession has been a big topic of conversation recently, and by the popular definition of the word (two consecutive quarters of reducing GDP) the US was already in recession by August. Officially, the US is never in recession unless a select group of economists picked by the National Bureau of Economic Research says it is, and, so far, they are not saying that because, in general, the economy is still doing quite well. However, there is a general feeling that a recession is looming if for no other reason than we talk ourselves into it, even if market forces donít force one on us. While the Fed hopes to avoid such a recession, that seems to be a price they are willing to pay to bring inflation under control.

One area that has started to feel the effects of rising interest rates is the housing market. Mortgage rates are not directly linked to the Fedís interest rate, but they have a tendency to follow them, and rising mortgage rates have been having an effect on demand for new housing. Of course, that has been starting from a high level of demand and a level of supply that was struggling to meet the demand. However, house prices have not shown much of a downward movement. Rents have also been rising in line with other costs, and rents get locked in for a year or more, so we are not likely to see those costs reducing much.

One effect the construction industry could see from a reduction in the housing market is that contractors who work in that market are going to be looking for other work to bid on. That can lead to even more competition for what is likely to be a diminishing volume of work as building owners face increasing finance costs and reduced demand for their goods and services as recession fears rise. This should bring construction costs under control and maybe reduce them, leading to opportunities for those who can afford to take them. Reductions in material costs are being seen, but they are mostly still well above the prices from a year ago, as are prices generally, so the Fed seems to still have reason to keep interest rates elevated. Unfortunately, since the inflation is largely a result of supply-chain issues, Covid, and the Russia-Ukraine war Ė none of which is under the Fedís control Ė keeping inflation low is likely to be a tough job.

Design consultant: Katie Levine of Vallance, Inc.