Printable PDF version

Subscribe to our newsletter

Constructing Climate Solutions

Quantum Construction

Whatís Happening?

Construction

Management Specialists

San Francisco, CA

(415) 981-9430 (San Francisco office)

Orinda, CA

(415) 981-9430 (Orinda office)

Rocklin, CA

(415) 872-0996 (Sacramento office)

San Diego, CA

(858) 886-7373 (San Diego office)

Redmond, WA

(206) 571-0128 (Seattle office)

Los Altos, CA

(650) 386-1728 (South Bay office)

Los Angeles, CA

(424) 343-2652 (Los Angeles, CA office)

Wicklow, Ireland

+353 86-600-1352 (Europe office)

www.TBDconsultants.com

Constructing Climate Solutions

Strange, record-breaking weather swings are starting to affect us as climate change bites. In this article we look at what this means for the construction site.

Recent developments in quantum computing have demonstrated that the technology is maturing. So, it is time to look at how quantum computers will fit into the construction process.

We are seeing market swings and analystsí predictions changing almost daily. Some think that we are headed for a recession, others expect a soft landing, and another group looks forward to dynamic growth. The idea of recession seems to have the majority vote, but when and how that will happen varies a lot.

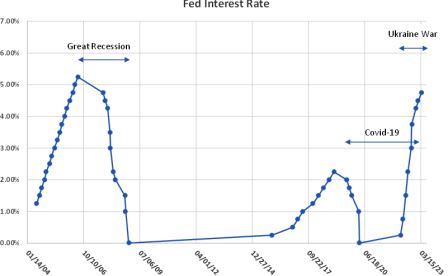

Earnings season at the start of the year showed S&P 500 companies being down an average of 1.3% on the quarter, but different sectors showed vastly different results. Tech companies as a whole fared badly, for example, while energy companies had record profits. Companies were predicting that future earnings would mostly be down, and more cautious consumers were expected. However, that didnít affect markets adversely, with investors seeing gloomy news as meaning that the Federal Reserve would likely pivot on the question of raising interest rates. It seems likely that the investors might need to be the ones to pivot.

Inflation may be softening a bit, but strong economic data indicate that interest rates will keep rising. It seems that we might have to learn to live with inflation and Covid for a while. The labor market added over 500,000 jobs in January, bringing unemployment to its lowest point since May 1969. That is bad for labor cost inflation and makes it look as though the Fedís interest hikes are not over yet.

Consumer spending makes up over half of US GDP and it had risen in January after a rough holiday season. However, it has been noted that consumers are spending more on services and less on nonessential goods as inflation hits their budgets.

Consumer debt has been rising although consumersí bank accounts still look good. Meanwhile, retail bankruptcies have been making news, as has the US debt ceiling. The Federal debt limit was reached in mid-January and consequently the US canít borrow more to pay its bills. If the debt limit isnít raised, we could see the US default on its financial obligations over summer, which would likely have the value of the dollar dropping and cause borrowing costs to rise even more.

The Fedís interest hikes resulted in the collapse and Federal takeover of two banks as the bonds that the banks had been holding lost much of their value and companies tried accessing more of their deposits to avoid high borrowing costs. The government had to step in to ensure that everyone got their money and stem the panic, but that doesnít help the Federal debt limit. The banks' problems did encourage the Fed to keep increases on the low end.

And, of course, we still have the war in Ukraine and sanctions on Russia, and the questions about what China will do. That leaves the health of globalization looking questionable.

Weíre interested in the construction market, of course, and architectural billings showed an improving situation through March, moving into solid growth conditions for most regions (the northeast being the softest). Work on infrastructure will remain strong, assuming government funding continues, but it has been suggested that we could see an overall 4% decline in the construction industry in 2023 because uncertainty and high borrowing costs make businesses wary of investing a lot in new developments. The real estate slump has led to layoffs at banks and mortgage companies as mortgage applications hit a 28-year low in February, but available housing remains in short supply so there is still good potential for the single-family construction market.

Things really seem to depend on what side effects the economy gets from the medicine that the Fed is prescribing.

Geoff Canham, Editor, TBD San Francisco

Design consultant: Katie Levine of Vallance, Inc.