In this Edition

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430

806 West Pennsylvania Ave.

San Diego, CA 92103

(619) 550-1187

www.TBDconsultants.com

Recession!

Geoff Canham, Editor

This quarter we are putting our regular articles on hold, in order to address the issues surrounding the recession.

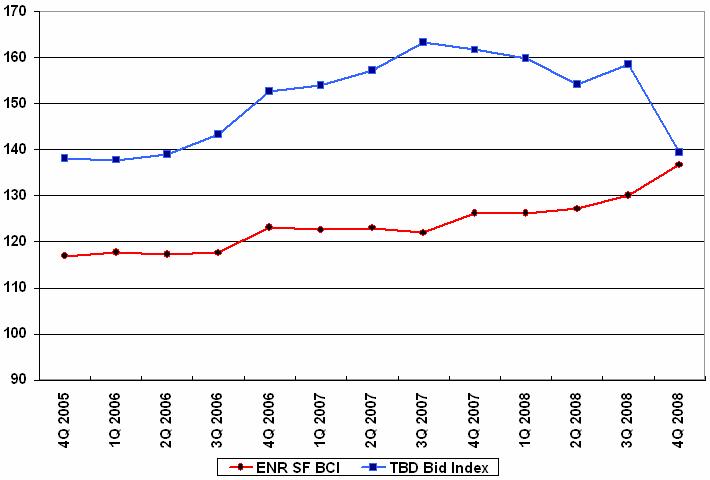

When we started writing this article (end of November 2008) the current financial crisis had not been officially declared as a recession. However, with our Bid Index resuming its downward dive despite labor agreements pushing the ENR index up, unemployment reaching levels not seen for a couple of decades, a $700 billion rescue scheme in place to shore up the financial institutions, yet another economic stimulus package being proposed to try and get the economy moving by getting people spending, and unprecedented international cooperation in fighting the crisis, then if this wasn't a recession it was obvious we would be in real trouble when one arrives!

The popular definition of a recession is two consecutive quarters of declining growth, but by that definition some of the recessions didn't occur, such as the one in 2001. The National Bureau of Economic Research (NBER) defines a recession as "a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP growth, real personal income, employment (non-farm payrolls), industrial production, and wholesale-retail sales", and in the US we are not officially in a recession until the NBER declares that we are. That declaration was made at the beginning of December, and we had expected that the start of the recession would be set somewhere near the start of 2008, and it was officially declared as starting December 2007.

The real question is not when the recession started, but when it will end, and there is no clear consensus on that. At the time of writing (Nov 2008) the best guess seems to be that it will extend through most of 2009 at least. The stock market normally begins to recover before the economy itself does, so by the middle of the year we might be seeing a steady re-growth there. Unfortunately, the construction industry tends to grow back after the economy itself, so it might be a further year or so before we are back to a level that could be considered normal.

But the recent election had some good news for the construction industry in the number of bonds that passed for construction-related projects, including almost all the school bonds (of course, the collapse of the bond market isn't helping with these projects). However, the money being pumped into the economy in the form of bail-outs and stimulus packages has to be helping somewhere, and the incoming Obama team is proposing another stimulus package, and possibly more work on infrastructure and school projects.

The infrastructure work is good for the future, but the lead time means that it may have little impact in recovering from the recession. The potential tax rebates of a stimulus package, or straight tax reductions, are more likely to have quick effects in getting the economy moving, but add possible inflationary pressures. There seems to be no easy answers, but history shows the cycle will turn.

Market & Escalation

Gordon

Beveridge

How is the recession affecting different sectors of the construction market, and how is escalation (or lack of it) likely to behave over the coming years? Gordon discusses these issues here.

In this article we take a look at two studies that examine effects we are going to see affecting bid prices as the recession continues to bite into the construction industry.

Design consultant: Katie Levine of Vallance, Inc.